Retirement Expenses

The Association of Superannuation Funds of Australia Limited (ASFA) is the largest policy, research and advocacy body for the Australian superannuation (pension) industry; a non-profit advisor to the Australian government.

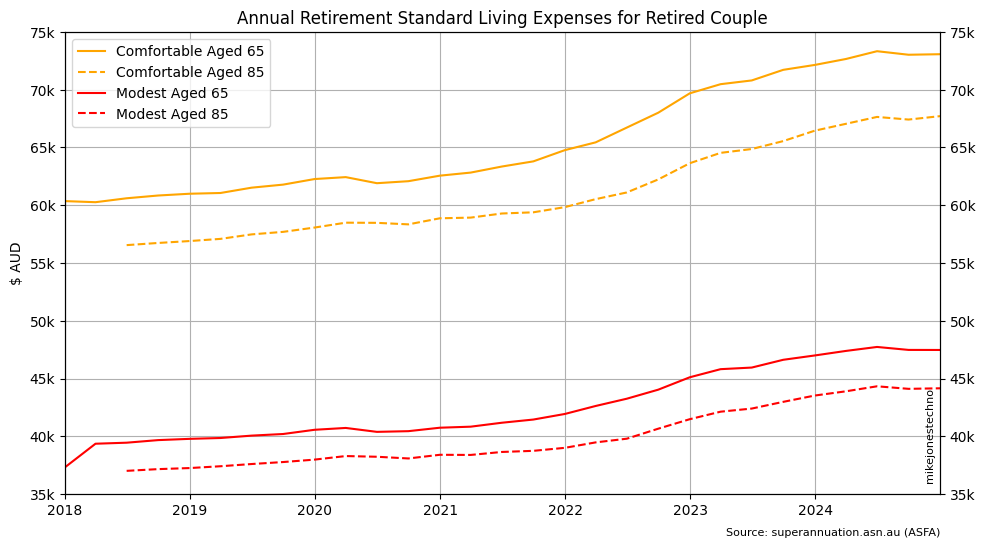

ASFA have published a “retirement standard” of living expenses that lists how much money the average Australian individual or couple spends each year in retirement. Their latest figures are based on previous 2018 research data (subsequently adjusted for inflation each quarter).

Retirement Lifestyles

The ASFA calculate retirement expenses for two lifestyles, a “modest” and a “comfortable” retirement lifestyle.

The ASFA define a “modest” retirement as having very basic and limited expenses, a cheap old car, and a “need to keep close watch on utility costs, and make sacrifices”.

The ASFA define a “comfortable” retirement, with approximately 55% higher expenses than the “modest” level, that enables a retiree “to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of things such as household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel”.

Both lifestyle levels assume retirees own their own home and are relatively healthy.

ASFA calculate the expenses for retirees aged 85 and over are approx 7% lower than those aged 65, because over 85 years any increased medical expenses are offset by significant reduction in travel and leisure expenses.

The ASFA retirement standard living expenses for a retired couple as of December 2024:

| Lifestyle Expenses | Modest Aged 65 | Modest Aged 85 | Comfortable Aged 65 | Comfortable Aged 85 |

|---|---|---|---|---|

| Annual | $47,470 | $44,152 | $73,077 | $67,714 |

| Monthly | $3,956 | $3,679 | $6,090 | $5,643 |

Misleading Data

⚠ WARNING: CHOICE say the ASFA Retirement Standard is misleading.

“The expert view is that these standards may be misleading (too high). The Productivity Commission said these standards equate to a retirement income that is ‘more than many people spend before retirement’, and that they are “no more than an arbitrary benchmark that should be ignored in policymaking”.

Fake News and Misinformation

The above statements from the Productivity Commission appear to be based on claims made by the Grattan Institute about the earlier ASFA 2009 research. The ASFA refuted these claims in their 2018 research stating that the ABS Household Expenditure Survey data indicates the mean and median disposable incomes of existing retirees are higher than the ASFA comfortable retirement standard.

I believe the ASFA could be a useful benchmark, subject to validation with actual personal expenses. Personalized data will tend to be more accurate than a generalized model.

While true that many people may be on a “modest” lifestyle before retirement, my actual expenses show the “comfortable” lifestyle is reasonably close to our current standard of living (less mortgage); the ASFA model appears reasonably accurate for a baseline model.

Improving Accuracy and Assumptions

Simplified Inflation

The ASFA standard is based on their 2018 research that they regularly adjust for inflation.

ASFA acknowledge that the CPI inflation data bundles goods and services that differ to the component budgets used in the retirement standard, but despite recognizing this potential source of inacuracy, the ASFA still apply a generic average inflation. The model could be more accurate if each component budget line item was individually adjusted, given cost of some goods can increase significantly while other expenses remain stable.

“All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent.”

Outdated Relevance

ASFA claim that adjusting for inflation “over the short term — a period which various researchers have indicated is in the order of around seven years — will not result in any major errors into the estimates in terms of overall required expenditure and the size of various components of the budgets”.

ASFA acknowledge over the longer term general living standards and expectations will increase “in line with economic growth and community prosperity”. After seven years technological innovations and price changes can have a dramatic effect on household budget.

“When almost everyone else has a mobile phone or a broadband internet connection, it becomes near impossible for anyone to manage without one. An item that was once seen as a relative ‘luxury’ quickly becomes an absolute ‘necessity’. Technology also changes, with, for instance, subscriptions to streaming services substantially replacing purchase of compact discs or DVDs.”

ASFA also acknowledge the need to periodically review government policy changes such as tax and health care benefits.

This means that projecting retirement expenses and balances beyond seven years could become increasingly flawed, particularly beyond fifteen years!

The ASFA retirement standard is due for a significant review and entire revision in 2025-26 (seven years from the 2018 baseline).

Precise Absolute Values

The ASFA standard has a split for individuals and couples, and for those aged over 85 which they assume will have higher medical expenses but much less international flights and entertainment expenses. It’s unclear to me how these absolute values are determined and what the real expense curves may look like.

It’s also unfortunate that the model attempts to calculate precise absolute values instead of a range of values with probability of those values.

Imagine that the ASFA forecasts of absolute values are out by +/- 20% to form a standard distribution range of values. Some expense categories could be forecast to greater degree of accuracy than others.

A monte carlo simulation could provide more reliable ranges of expense probability forecasts rather than the absolute values provided by the standard model.

Lifestyle Sensitivity

It is unclear if or how the ASFA model forecasts price sensitivity for each lifestyle, given that some expense categories such as food are more essential than others.

Higher inflation on essential services and groceries will have signicant impact to those on a modest retirement that are living day to day and “need to keep close watch on utility costs, and make sacrifices”. Those on a comfortable lifestyle will be far less impacted.

Similarly higher inflation on luxury items and travel will have signicant impact to those on a comfortable retirement but almost zero impact to those on a modest lifestyle.

It’s not clear to me how accurate the ASFA category weighting is for each lifestyle and if it could be modelled more accurately.

There is an opportunity to develop a more accurate modelling of expenses, based on my own actual expenses, however the ASFA appears reasonably accurate for an initial baseline model.