Inflation and Interest Rates

Inflation

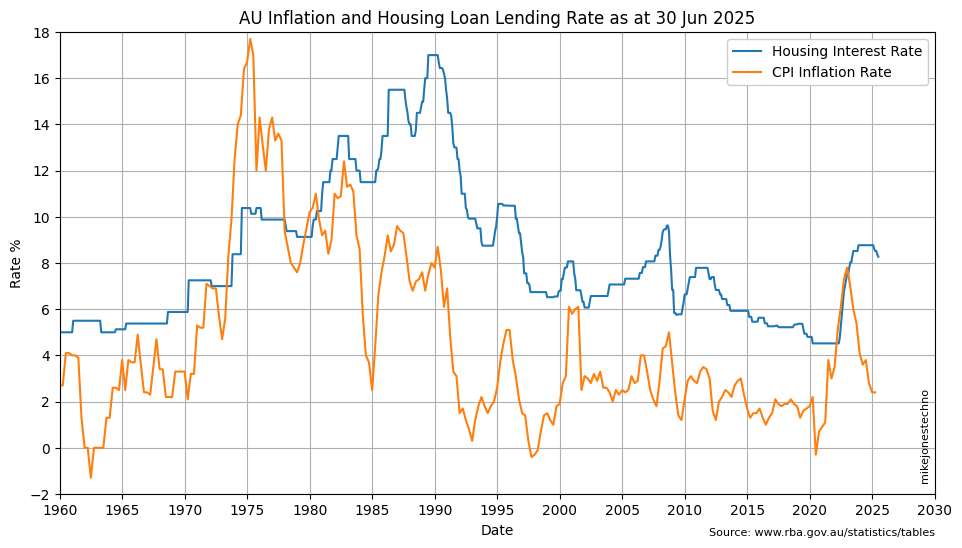

The Consumer Price Index that the Reserve Bank of Australia use to index inflation is published quarterly, one month after the end of each quarter.

See inflation for inflation charts, trends and analysis.

Interest Rates

The Housing Loan Lending Rates are set by the Reserve Bank of Australia and published monthly within five business days after month end.

See interest rates for interest rate charts, trends and analysis.

Inflation and Interest Rates

The Reserve Bank of Australia has often increased base interest rates alledging a high correlation between interest rates, inflation and wage growth.

This appears a reasonable construct from basic supply and demand economics; when households have high disposable income due to wage growth, demand for non-essential goods and services increases, and if supply is limited, prices increase to meet demand, resulting in inflation.

Increasing interest rates reduces disposable income (for those with borrowing debt), thus reducing some demand for non-essential goods and services, potentially resulting in some price reductions, and subsequently reducing inflation.

Is there really a high correlation, or is this over simplification? Is wage growth the primary cause of inflation? Does increasing interest rates directly cause inflation to fall?

Perhaps there are other external factors influencing inflation, such as global oil prices, foreign war, pandemic supply chains, monopoly corporate profit greed, excessive government debt spending ‘money printing’, and other factors that have nothing to do with wage growth and household disposable income?